We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

What is a Payroll Calculator?

Payroll is more complicated than giving each employee their exact amount earned each pay period. Instead, as an employer, you have to withhold taxes from each employee’s paycheck. Withholdings might also include premiums for your business’s vision, dental, and medical insurance plans; wage garnishments; or voluntary donations.

But how can you figure out how much should be deducted from each paycheck? A payroll (or paycheck) calculator is a tool that calculates tax withholdings and other deductions from an employee’s gross pay— which makes it easier to give your employees the right net pay at the end of the pay period. Thanks to their tax accuracy, paycheck calculators can also relieve some of the stress we all associate with tax season.

Payroll calculators for employers are tailored to all sorts of employee situations. There are hourly and salary payroll calculators, weekly and bi-weekly paycheck calculators, or even calculators that ensure you give your 1099 (or freelance) employees the right gross pay.

You can use our free payroll calculator or use the calculator included with your small business’s accounting or payroll software.

Payroll calculator components

So how do you know your payroll calculator passes muster? Both a payroll calculator included with your accounting software and a free online payroll calculator should include variations on the following components.

Employee and pay information

Enter each employee’s net pay and indicate how often they get paid—that’s usually weekly or bi-weekly.

Hours worked

Hourly payroll calculators should include a space for you to enter your employee’s exact time worked. Salary paycheck calculators should include a space for you to indicate how many hours a salaried employee works in a pay period. You can also find payroll calculators that include space for overtime and holiday pay. Plus, some calculators help you track year-to-date gross pay.

Federal tax information

Payroll calculators use the most up-to-date federal tax rate to tell you how much money you should set aside from your employee’s gross pay—all you have to do is input the right employee information:

- The employee’s filing status (married, single, or married but filing at the higher single rate)

- The number of federal allowances

- Whether your employee is exempt from Social Security and Medicare taxes or the federal income tax

State tax information

Your payroll withholding calculator will have a drop-down menu where you can select your state. The calculator then automatically knows how much to withhold per your state’s tax laws. You can also insert additional state tax withholding or check a box if your employee is exempt from state taxes.

Custom deductions

Most payroll calculators include a space for an employer to enter workplace-specific deductions, including the following:

- 401(k) contributions

- Healthcare premiums

- Donations to charitable establishments

- Other retirement savings accounts

The takeaway

Paycheck calculators are a great way too quickly, easily, and affordably calculate taxable income and net pay, especially if you use a free payroll calculator. Even better, they help both the employer and employees of any small business feel confident that they’re receiving the right amount on their pay stubs—and that they won’t run into trouble when tax season rolls around.

Need more accounting help than a basic payroll deductions calculator? Check out our piece on the best accounting software to find the right payroll and accounting service for your business.

By signing up I agree to the Terms of Use and Privacy Policy.

How Asking for a Raise Can Affect Your Lifetime Pay

In the long run, it pays to be proactive in asking for the best salary for your hard work. You can miss out on hundreds of thousands, possibly even millions of dollars if you wait to ask for a raise every five years or more.1 Worse yet, some people never ask for a salary increase.

We asked Americans what they think about pay raises—and after seeing some unfortunate responses, we crunched the numbers to demonstrate how your lifetime income can snowball when you start asking for raises earlier and more often.

What do American workers think about asking for a raise?

Most Americans don’t mind asking for a raise, despite nervousness—but some people never ask at all, believing either they don’t deserve a yearly raise, or that their boss wouldn’t give it to them.

- Most Americans (59%) don’t mind asking for a raise when they know they deserve it.

- Just under half (48%) are nervous about asking for raises even if they feel like they deserve it.

- At least 37% believe they should get a pay raise once a year.

- Only 21% report that they have asked for a pay raise in the last year.

Unfortunately, nearly one in four of our survey respondents have never asked for a pay raise in their career. Up to 22% report that they don’t feel their boss would say yes to a pay raise, so they don’t bother asking.

How much of a raise do most people ask for?

While most Americans are willing to ask for a 10%–12% increase or less, men are more likely than women to ask for higher percentage raises.

- The majority of Americans would ask for a 10%–12% increase.

- Most Americans (73%) are more comfortable asking for 12% increases or below, while only 27% of Americans are willing to ask for more than 12%.

- 22% of respondents report only being willing to ask for 3%–5%, which usually only covers the cost of living increases.

- From our survey, the highest percentage of men (31%) responded that they’re willing to ask for a 10%–12% increase, while the highest percentage of women (30%) reported they’re only willing to ask for 6%–9% increases.

Every percentage point helps to snowball your salary, but think less about how to make giant leaps every 5 to 10 years, and more how to make consistent raises happen (at least) every other year.

Comparing pay raises by age and frequency

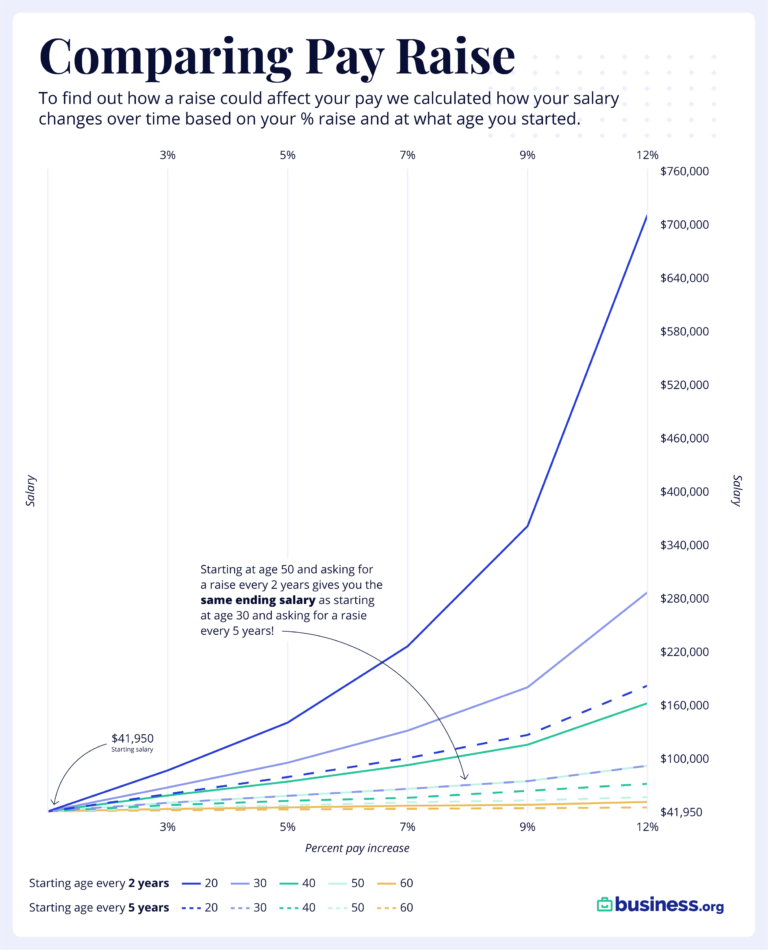

To find out how much money you could be missing out on by not asking for raises, we used the average salary for all occupations in the US ($41,950)2 and then compared it across different working age groups (20s, 30s, 40s, 50s, and 60s) and different frequencies of asking for a raise (2 years or 5 years).

For example: If you start at age 50 and ask for a raise every 2 years from now on, you’ll end with the same salary as if you started at age 30 but had only asked for a raise every 5 years. The power of more persistent percentage raises cuts ahead twenty years of difference in ending pay.

So, what difference in total pay does a few years make? Asking for a 5% raise every 2 years instead of every 5 years can help you earn up to $1,106,824 more over your career.

To better understand how the math breaks down, and how that might translate across your current salary and age, we’ve built this table to demonstrate the different increases across different ages:

How a pay raise can affect your salary over time

Asking for raises often can make a million-dollar difference

We encourage everyone to ask for more pay, more often. Over your lifetime, it’s worth overcoming those nervous and hopeless feelings. At worst, your boss will reject your offer and you’ll be no worse off in salary pay, and you can explore other options for making more money.

You can ask for feedback to improve your work in your current role (although we learned that only 21% of Americans believe that their pay raise should be based on performance, rather than tenure). Or if you’re feeling a bit burnt out about hitting a paywall at your gig, it may be time to take your talents elsewhere—and ask for a salary increase while you’re at it.

Methodology

To find out how a raise could affect your pay, we made a calculator demonstrating how your salary will change over time based on the percentage and frequency of raises. All occupational group salaries were sourced from the Bureau of Labor Statics.

We partnered with Pollfish to conduct an anonymous survey of 700 working Americans. Business.org analyzed the results and compiled this report. To learn more about Pollfish and how it organically finds respondents, check out its methodology.

Sources

- Bureau of Labor Statistics, “Occupational Employment and Wage Statistics.” Accessed August 24, 2021.

- Proprietary Pollfish survey, conducted in August 2021.

Disclaimer

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.