We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

Bank of America Small-Business Banking Review 2023: Big Rewards, If You Qualify

Data as of 12/8/22. Offers and availability may vary by location and are subject to change.

At first glance, Bank of America looks great for business banking. It has locations across the United States, it offers your choice of business checking and savings accounts, and it offers small-business financing and other services.

But as we found, Bank of America is only a good fit for some businesses. For business owners that qualify for its Preferred Rewards program, it offers decent rates and discounts across a variety of accounts and services. But without that Rewards program, Bank of America accounts are just okay―pretty expensive, even. Plus, the customer reviews aren’t great.

We’ll tell you more about both the good and the bad to help you decide if Bank of America will work for your business.

Bank of America accounts and pricing

Let’s start with the basics: business bank accounts. Bank of America has checking accounts, savings accounts, and certificates of deposit—the usual.

Checking accounts

While Bank of America didn’t quite make our list of the best small-business checking accounts, it does have some okay account options.

Bank of America used to have several different checking account options. These days, it offers one primary account―Business Advantage Banking―with two “settings.” (It also has analysis checking, but most small businesses won't want that.)

Bank of America small-business checking accounts

Data as of 12/8/22. Offers and availability may vary by location and are subject to change.

Business Fundamentals Checking is the more basic Bank of America checking account option. It has the lowest monthly maintenance fee, which you can get waived if you make $250 of purchases on a business debit card (either credit or debit), maintain an average monthly balance of $5,000, or enroll in Preferred Rewards for Business (which we'll talk about later).

The Business Advantage Relationship Checking setting has a higher monthly fee, but it gives you perks like more free transactions, a higher free cash deposit limit, free account management, and a free additional checking account. You can waive its monthly fee in one of two ways: if you have an average monthly balance of $15,000 in your account or become a Preferred Rewards for Business member.

Note that you can add a Second Business Advantage Banking account to either your Fundamentals or Relationship account. With a Fundamental account, a second account costs $12 per month. With a Relationship account, it’s free.

Finally, Bank of America offers Full Analysis Business Checking for big spenders, but you’ll have to talk to your banker to get any details. It’s all very hush-hush. As with any analysis checking account, though, you’ll pay fees for every deposit and transaction―but you’ll get credits for your account balance.

By signing up I agree to the Terms of Use.

Savings accounts

Bank of America now has just one business savings account, plus some certificates of deposit (CDs)—no money market accounts here.

Bank of America small-business savings account fees

Data as of 12/8/22. Offers and availability may vary by location and are subject to change.

The Business Advantage Savings account comes with a pretty low APY (annual percentage yield) when compared to some online banks―especially if you’re not a Preferred Rewards for Business member. Note too that you can’t write checks from this savings account.

At least you can waive the $10 monthly fee if you have a Business Advantage Relationship Checking account or if you belong to Preferred Rewards for Business.

Then you have the certificates of deposit.

Data as of 12/8/22. Offers and availability may vary by location and are subject to change.

Bank of America’s CDs can be as short as one month or as long as one decade. The APY on these varies quite a bit, depending on both your term and your deposit. And keep in mind, as with all CDs, you won’t be able to touch your funds—to add or withdraw money—until your term is up.

So how do Bank of America’s saving options stack up? Well, its business savings accounts—both standard savings accounts and CDs—have relatively low APY. We’ve seen much better rates (even on checking accounts) at our favorite online banks for small business.

But that doesn’t necessarily mean you should skip Bank of America. Because for certain businesses, the rewards far outweigh any higher fees or lower APYs.

Bank of America’s small-business rewards program

Okay, so we’ve mentioned a reward program several times now. But what is it, and what can it get you?

Bank of America’s reward program, Preferred Rewards for Business, gives you perks for its various financial products. You can, for example, get discounted interest rates on loans, refunds on payroll services, or increased interest on your savings account.

There are three levels to the program: Gold, Platinum, and Platinum Honors. All three levels waive many banking fees (including monthly fees, inbound wire fees, and stop payments). But just as you’d guess, you get better perks with the higher levels.

Bank of America Preferred Rewards for Business

Data as of 12/8/22. Offers and availability may vary by location and are subject to change.

To qualify for even a basic (Gold) Preferred Rewards status, you need $20,000 spread across your business accounts, and the amounts only go up from there. Many businesses don’t have that kind of cash laying around.

So while the perks can be great, you can probably see why we don’t recommend Bank of America and its relationship rewards program for everyone.

Still, if you do maintain average account balances in that range (good for you!), and you want to get all your business financial products in one place, Bank of America provides great incentives to do so.

Bank of America vs. competitor banks

Wondering how Bank of America looks next to other banks for business?

Data as of 12/8/22. Offers and availability may vary by location and are subject to change.

On the plus side, Bank of America operates in more states than pretty much any other traditional bank. But online banks still beat it in availability, since they do business in all 50 states.

And while Bank of America isn’t the most expensive bank out there, it’s not the cheapest traditional bank―and again, online banks blow it out of the water with their totally free checking accounts.

Put simply, Bank of America offers an okay banking experience for a traditional bank―nothing exceptional. But it’s definitely more expensive and less available than online banks.

Drawbacks

As comparing Bank of America to competitors shows you, Bank of America does have some big downsides to consider.

Availability

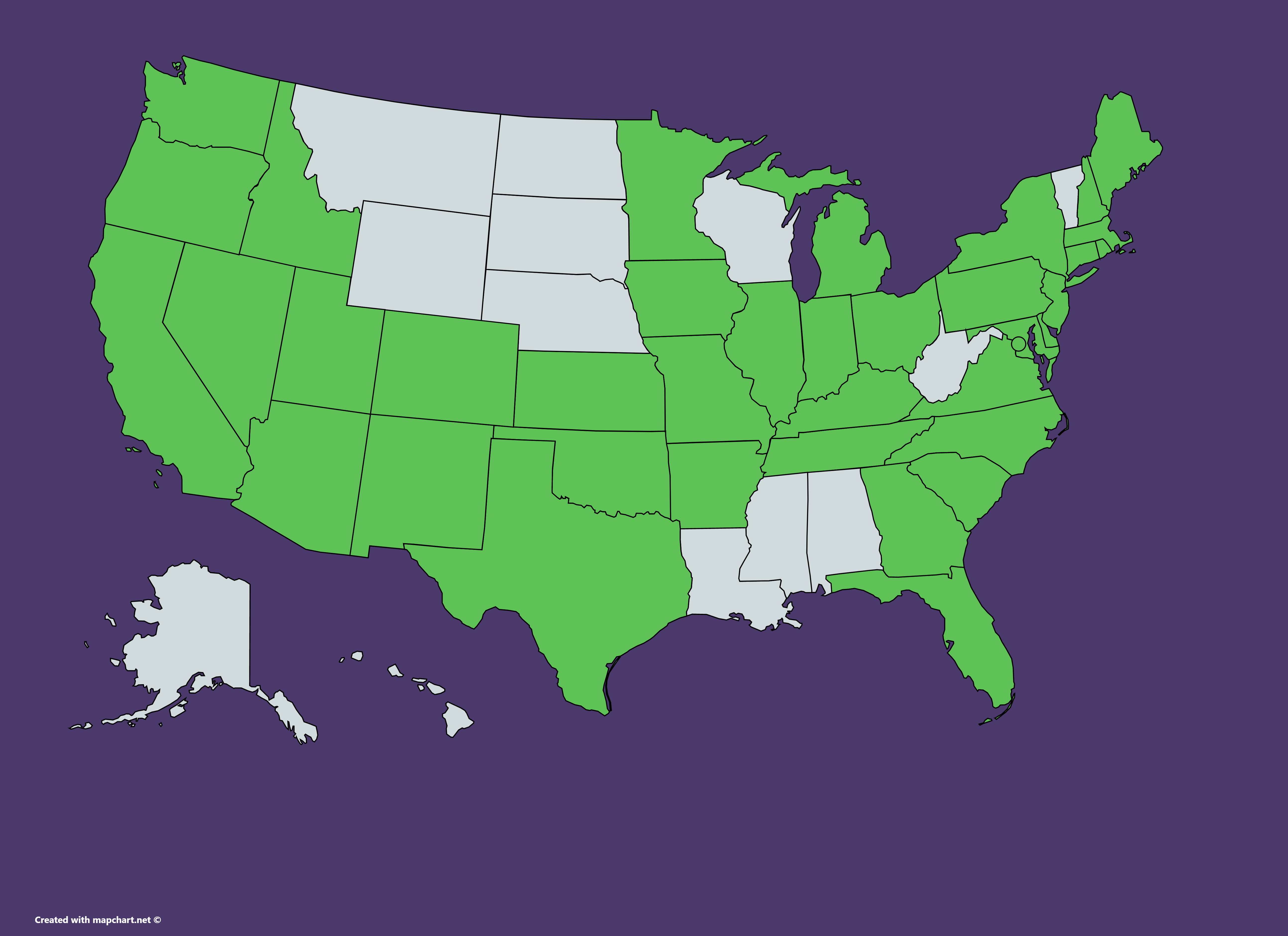

First, availability. While Bank of America operates in more states than any other traditional bank―37 states―it’s not everywhere.

Bank of America availability

So if you’re in, say, the Dakotas, you’ll need to go with a different bank. Or even if you’re headquartered in Denver but have a satellite office in Baton Rouge, you may want to find a bank that’s available to all your business branches.

(And if you need helping finding one, we’ve got a list of the best banks in your state.)

Rewards

Second, if you want to get the most from Bank of America (a.k.a. BoA or BofA), you’ll want to use its higher-tier bank accounts, take advantage of several of its financial products, and get in on its Preferred Rewards for Business program so you can get discounts on those products.

But to do all that, you’ll need to have quite a lot of cash on hand: For example, you’ll need $20,000 across your Bank of America business accounts to take part in its Preferred Rewards program. And to get a business loan, you’ll need a minimum annual revenue of $100,000.

Without that Rewards program, though, Bank of America doesn’t have especially competitive account fees or interest rates. And while its loans are competitive either way, they’re out of reach for young businesses or businesses without much revenue.

In other words, if you have a new business with almost no cash, or you regularly experience cash flow challenges, Bank of America probably doesn’t have a ton to offer you.

Other small-business products and services from Bank of America

Speaking of offering you things, let’s take a look at all the other products Bank of America has for small businesses.

Small-business financing

Bank of America has quite the wide variety of small-business loans, from small unsecured lines of credit to multi-million dollar medical practice loans.

Compare Bank of America’s small-business lending

Data as of 12/8/22. Offers and availability may vary by location and are subject to change.

Its rates are definitely competitive—better than you’d find from most alternative lenders—but only if you can qualify.

To get one of BoA’s Business Advantage loans or lines of credit, your business needs to be at least two years old and generate $100,000 in annual revenue—plus you need a solid personal credit score (pretty liberal criteria for a traditional bank, really).

And for the other loans? Still two years in business and a strong credit score, but you need at least $250,000 in revenue to be in the running.

For a deeper dive into BoA’s financing options, check out our Bank of America small-business loans review.

Small-business credit cards

If you’d rather apply for a business credit card than take out a loan (not that you can’t do both), you can get one of Bank of America’s five different credit cards. BoA has both Mastercard and Visa options, with a variety of perks ranging from cash rewards to travel points.

Miscellaneous

- 401(k)s for sole proprietors and small businesses

- Health savings accounts (HSAs)

- Merchant services (point-of-sale systems and credit card readers)

- Payroll services

- Invoicing and payment system

How to open a Bank of America business bank account

Interested in banking with Bank of America?

Lucky for you, Bank of America makes it easy to open a bank account. In fact, it lets you initiate the process at your local branch, over the phone, or on its website. Here’s the rundown:

- Decide which Bank of America bank account you want to open.

- Get all your business documents together (articles of organization, tax ID, etc.).

- Contact BoA—online, over the phone, or at a branch—to apply.

- Give BoA your business documents (by email or fax, if necessary).

- Sign a signature card and deliver it to BoA (in person or by mail).

- Fund your new bank account.

For more information on opening your new account, check out our guide on how to open a business bank account.

Bank of America customer reviews

One more thing before we go.

Bank of America used to have pretty average ratings from customers, but its scores have dropped quite a bit in the last couple years. BoA has a 1.4 out 10 on Trustpilot and a 2.5 out of 5 on Bank Branch Locator.1,2 (For what it’s worth, we’ve seen worse.)

The positive reviews praise Bank of America’s customer service. They also have great things to say about Bank of America online banking, with many customers loving that they don’t have to speak with tellers much, if ever.

The negative reviews say pretty much the opposite, though. People complain about poor customer service, and they claim that Bank of America mobile banking is either broken or hard to navigate, as is the BoA website. They also say it’s too hard to get help from a real human. (Note that Bank of America doesn’t have 24/7 customer service.)

Your mileage will probably vary depending on your relationship with technology and (as with most traditional banks) the staff at your local BoA branch.

At least, unlike some of the competition, Bank of America has an A+ from BBB—no company-wide scandals here.3

The takeaway

Ultimately, there are good reasons why Bank of America was an honorable mention on our list of the best banks for small business: it’s relatively widely available, and it has a robust rewards program for business owners.

But you can find cheaper banks out there, and small or new businesses may not be able to take advantage of the things that set Bank of America small-business banking apart.

As for whether it’s the right bank for your business? That’s for you to decide—but we hope our review helped!

Not convinced by Bank of America? Find an alternative on our list of the best banks for small business.

Related content

Methodology

We researched all we could about Bank of America, then scored it on key factors such as bank account fees, customer reviews, and availability across the nation. We used the resulting scores to review Bank of America and compare it to other banks.

Bank of America FAQ

That depends on the account type. If you're opening a business checking account, the minimum amount you'll need is a $100 opening deposit plus the ability to pay $16 monthly. For a business savings account, the minimum amount you'll need is $100 to open and the ability to pay $10 monthly. CDs, on the other hand, have a minimum opening deposit of $1,000.

The approval process takes 1-2 business days.

Disclaimer

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.