We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

Chase Business Bank Review 2023

Data effective 12/2/22. At publishing time, rates, fees, and requirements are current but are subject to change. Offers may not be available in all areas.

*Waivable with a minimum daily balance of over $2,000

JPMorgan Chase & Co., better known as Chase Bank to its friends and customers, is the largest bank in the United States.1 No wonder you’re thinking about doing your business banking with this well-known giant.

Well, we hate to break it to you, but we don’t recommend banking with Chase, thanks to its pattern of sketchy and downright illegal behaviors, its poor customer reviews, and its less-than-competitive bank account pricing. To see our top picks, check out our breakdown of the best small business banks.

That said, Chase does have plenty of accounts and products to choose from (including some great business credit cards), and it’s more widely available than many banks. Don’t worry, we’ll explain all that in greater detail as we go on.

Ready for the scoop?

Chase review table of contents

By signing up I agree to the Terms of Use and Privacy Policy.

Chase business bank accounts and pricing

As you’d expect from a big bank like Chase, you have choices between several different types of business checking and savings accounts. Let’s look at your checking choices first.

Chase business checking accounts

Chase has three business checking accounts (plus one interest-bearing checking alternative, if that’s your jam).

Chase small-business checking accounts

Data effective 12/2/22. At publishing time, rates, fees, and requirements are current but are subject to change. Offers may not be available in all areas.

Chase’s Business Complete Checking is its cheapest, most basic account. You can waive the monthly fee by keeping a $2,000 minimum balance, linking it to a Chase Private Client Checking account, making $2,000 in purchases on a Chase Ink credit card, or by making $2,000 in merchant services deposits.

If you want more free transactions, higher free cash deposit amounts, and fewer ATM fees, you can go for Performance Business Checking. Just know that if you want to waive the monthly fee, you’ll need a daily average of $35,000 across your Chase business accounts.

You can also get an interest-bearing version: Chase Performance Business Checking with Interest. It’s pretty much the same account, just with the chance to earn some interest on your money―and no way to waive the monthly fee. You can earn 0.01% APY on your Performance Business Checking account―certainly nothing to write home about. (By way of comparison, Bluevine’s free business checking account offers 2.0% APY.)

Finally, you have Platinum Business Checking. It gives you the most free transactions and cash deposits, but it has one of the highest monthly fees we’ve seen. And to waive that maintenance fee, you’ll need a daily average of $100,000 in your business banking or investment accounts. On the other hand, it does give you completely free incoming wires and a handful of free outgoing wire transfers.

These accounts don’t have the highest costs we’ve ever seen, but they’re far from the lowest we’ve seen. We’ve found cheaper rates and fees at both online banks for business and regional banks (like TD Bank). But Chase does sometimes offer deals for new business customers, like a $200 bonus when you open a checking account.

Is that enough to make up for its mediocre pricing? Up to you.

Chase also has some specialized checking accounts, including both analyzed checking accounts and escrow checking accounts for attorneys and real estate brokers.

Chase specialized business checking accounts

Data effective 12/2/22. At publishing time, rates, fees, and requirements are current but are subject to change. Offers may not be available in all areas.

Its analyzed checking accounts work like any other analysis checking account, meaning you earn credit based on your account balance. Then that credit gets applied to your account fees. So if you keep a high account balance, analysis checking accounts can offer a great deal. (For lower account balances, though, the fees can eat you alive.)

Chase also offers an interest-bearing version of its analyzed checking. In exchange for earning interest (0.14%), you don’t get the chance to collect earnings credits. Instead, you’ll just have to pay for the fees yourself. Definitely do the math before committing to this account.

As for Chase’s escrow accounts? You just need to know that they comply with all the relevant regulations. (And if you don’t already know what these accounts are and how they work, that means that they don’t apply to you.)

Chase savings accounts

In addition to its checking accounts, Chase also has a handful of savings accounts for you to choose from: two standard savings accounts and certificates of deposit (CDs). (If you want a money market account, you’ll need to go elsewhere.)

Chase small-business savings accounts

Data effective 12/2/22. At publishing time, rates, fees, and requirements are current but are subject to change. Offers may not be available in all areas.

The Total Savings account has a low monthly maintenance fee, which you can waive by keeping a $1,000 account balance. Another option for waiving the fee? Linking your Total Savings account to a Total Business Checking account. Pretty easy. While it does earn some interest, the APY for Total Savings is quite low.

For a shot at a higher (but still low) APY, you can opt for Premier Savings instead. In this account, the more you save, the higher your APY. And you’ll need a healthy account balance to waive the monthly service fee. Waiving the fee requires a $25,000 average balance, or you can link your account to a Performance Business Checking, Analysis Business Checking, or Platinum Business Checking account.

Note that Chase has a limit of six transactions per monthly cycle on its Total Savings and Premier Savings accounts. That used to be because of Regulation D, a federal rule that limited transactions on savings accounts. But now that the law has changed, Chase has kept its limit in place anyway. So if you make more than six transactions per month from your Chase savings account, you’ll get hit with a $5 fee per transaction.

Your final savings option? Chase’s certificates of deposit. But, uh, the APY on these isn’t that great. The starting APY is quite low, and even the maximum APY is way lower than you can find from other banks. And remember, you won’t be able to add or withdraw funds for the length of your term—between 1 and 60 months, depending on what term you choose.

Any of this sound tempting? Then let’s figure out if you should take the plunge to apply with Chase.

Reasons to bank with Chase

This is where we’d normally tell you about some cool feature that makes Chase stand out from the crowd. But as you may have noticed, we don’t have a ton of praise for Chase Bank.

Still, in the interest of fairness, we’ll tell you some reasons you might want to bank with Chase, despite our protestations.

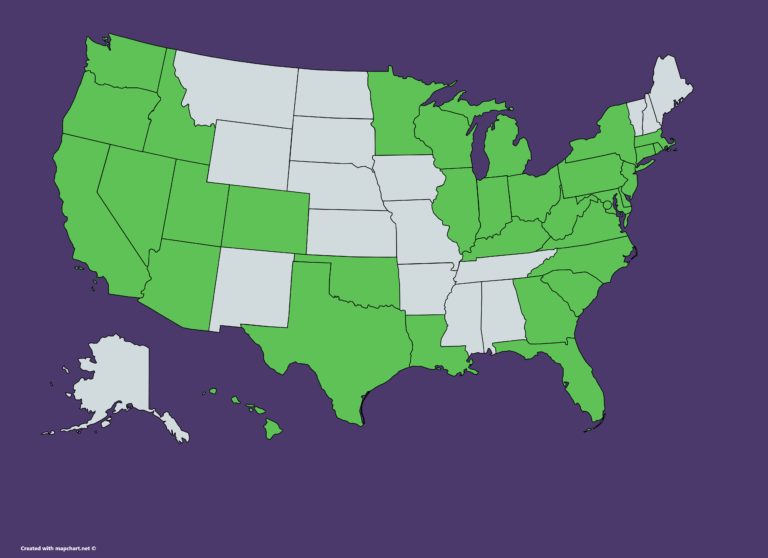

For example, as we discussed above, you might live in Hawaii and have limited options. It happens.

Or maybe you already have and like a personal account with Chase. And you might find that Chase is just really convenient, like this business owner did:

We get it—you’re a busy business owner. Maybe a nearby location to drop off cash deposits really matters to you. In that case, Chase might work well for your business.

And as Logan Allec noted, Chase often has special offers when you open a business checking account (only $300 as of this writing). So that’s another nice incentive for you.

Or maybe you’re just really into some of the other products Chase has to offer your business.

But before you commit to Chase, let’s talk more about some of the other banks you could choose instead.

Chase vs. other banks for business

Data effective 12/2/22. At publishing time, rates, fees, and requirements are current but are subject to change. Offers may not be available in all areas.

As you can see, Chase is one of the pricier options for traditional banks, and it costs way more than online banks (which often offer almost completely fee-free checking). So you’re not exactly getting a steal of a deal by banking with Chase.

And while Chase is more widely available than many traditional banks, there are big-name banks with even bigger footprints. Or you can go with an online bank, which tends to offer service in all states.

But we really do recommend going with a bank that’s not Chase―and not just because it’s a little on the pricey side.

Chase drawbacks

We want to be completely honest here: we have a hard time recommending Chase to anyone.

In part, that’s because Chase doesn’t really have any standout features. Other banks have cheaper business bank accounts. You can find higher annual percentage yield (APY) on business savings accounts and CDs elsewhere. Its business financing is fine, but not the best. In other words, Chase is just kind of okay.

Then there’s that other thing: Chase’s long and storied history of, well, super sketchy stuff. Here’s a small sampling of things Chase has been sued for in the last decade:

- Discriminating against black and Latinx mortgage borrowers2

- Charging customers for credit monitoring they didn’t get3

- Processing transactions out of order so it could profit from overdraft fees4

- Improperly foreclosing or overcharging military members on their mortgages5

- Conducting illegal business with customers in Iran, Sudan, Cuba, and Liberia6

Since you don’t have all day, we’ll stop there. But let us stress that there is much, much, much more where those came from. And sure, lots of banks have faced government action (yes, we’re talking about you, Wells Fargo and CitiBank!), but few have quite as many as Chase.

And sure, those scandals may not have specifically affected Chase business banking customers. But with a history like that, we wouldn’t be surprised if the next scandal does. (Because given Chase’s track record, it’s safe to assume more scandals are coming.)

Plus, given that many of Chase’s lawsuits are about problems that directly affect the consumer—from fraudulent charges to inflated interest rates—we can’t just look the other way. This is your business we’re talking about, after all. We don’t want to let a bank scam you out of your hard-earned money, no matter how big and old that bank is.

Fortunately, the vast majority of states have better banks to choose from, so you can take your business dollars elsewhere.

Chase availability

And if you still find yourself tempted by Chase? Well, let’s make sure you know what existing customers have to say.

Chase customer reviews

Chase has a pretty poor 1.3 out of 5 on Trustpilot,7 but it fares better on Bank Branch Locator, where it has a 3.0 (and dropping) out of 5.8

Many negative reviews complain about poor customer service, which isn’t unusual among the banks we’ve reviewed. More unusual? Allegations that Chase doesn’t honor its offers (like giving you $300 for opening a business checking account) and complaints that Chase mishandles fraud cases. While we can’t necessarily verify these stories, they wouldn’t surprise us, given Chase’s legal record.

So what about the good reviews? While we saw some glowing reviews about Chase’s mobile app, most of the good reviews praise its customer service. In fact, when we asked small-business owners about their bank accounts, we got a couple positive reviews of Chase’s customer service. Like this one:

One last thing, while we’re on the topic of Chase’s reputation. When we wrote “Best Banks for Small-Business Checking”, Chase had an F with the Better Business Bureau (BBB) because of government action against it. Sometime in the past couple of years, that score was upgraded to a A, presumably because that case had been settled (along with so many others).9

That probably says more about how the BBB scores businesses than it does about how much you should trust Chase, though. (BBB scores often reflect how much a business is willing to pay rather than how good it is—learn more in our guide to the Better Business Bureau.)

But if you still think you want to bank with Chase, despite our warnings, then we at least want you to be well-informed about what it has to offer. So let’s explore what products and services Chase has for small business.

Other small-business products and services from Chase

Chase offers more than just banking. It also has a variety of financing (including loans, lines of credit, and business credit cards), plus some other services for business owners.

Small-business financing

Chase is pretty cagey about its financing. If you want to apply—or get more information—you have to visit your local branch. Feels pretty inconvenient in this age of online lenders, doesn’t it?

(Other banks we’ve reviewed have prominent phone numbers and online chat options to answer any questions you have. Chase doesn’t.)

Compare Chase’s small-business lending

Data effective 12/2/22. At publishing time, rates, fees, and requirements are current but are subject to change. Offers may not be available in all areas.

Chase doesn’t publish its small-business loan application criteria (again, you have to visit your branch to find out), but if it’s anything like other big banks, you’ll need a good credit score, at least a couple years in business, and revenue of at least $200,000. In return, you’ll probably get lower rates than you could find through an alternative lender.

One good thing about Chase’s lending? It’s an SBA-preferred lender. So if you’ve been thinking about getting an SBA loan (a loan backed by the U.S. Small Business Administration), Chase can help you get approved faster than many other lenders.

You can also get trade financing with Chase. But surprise! You’ll need to visit a Chase branch to get any details on that.

Small-business credit cards

Aside from its loans and lines of credit, Chase also offers six business credit cards. And while we dislike Chase as a whole, we have to admit it has solid credit cards. Several of its business credit card options made our list of the best business credit cards, thanks to their big rewards, relatively low fees, and competitive signup bonuses.

You can get various types of rewards from these Visa cards, such as cash back (up to 5%!) and travel points. Plus, like we mentioned, all six cards have point or cash bonus offers when you first open the card, though you may need to spend a certain amount to qualify.

As you pick your business credit card, keep in mind that several of these cards do have an annual fee. You may want to do some quick math and make sure you won’t end up paying more in annual fees than you’ll be earning in rewards.

Merchant services

Need a way to accept credit card payments? Enter Chase’s merchant services.

Chase has plenty of terminal options, including mobile credit card readers, standalone payment terminals, and even virtual terminals. You can also build your own point-of-sale (POS) system with its POS tablet and accessories (like a cash drawer and receipt printer).

And if you already have a terminal or POS system you like, you may be able to use Chase’s payment processing with your existing solution. A Chase payment specialist can help you figure out how.

Miscellaneous

Finally, Chase has a few more business services that may interest you:

- Cash collection services

- QuickDeposit desktop check scanner

- Bill pay directory

The takeaway

Look, we’re pretty skeptical of Chase business banking—or more accurately, we’re pretty skeptical of Chase as a whole. It’s got a history of bad behavior, gets not-so-hot customer reviews, and we’ve seen better deals elsewhere.

So while Chase Bank offers plenty to businesses, like bank accounts, financing, merchant services, and some pretty competitive credit cards, we’d rather see you give your cash to a different bank.

But ultimately, you know your needs, you know your business, and you know what you’re comfortable with. At this point, the choice is yours. We just hope we helped you make it.

Want an alternative to Chase? Great! Check out our ranking of the best banks for small-business to find one.

Chase Business Bank Frequently Asked Questions

The amount of money necessary to open a Chase business account is not listed. This is definitely one of those things that require you to go to the bank and inquire yourself. We know that is annoying, but it is not listed.

Whether Chase is a good bank for startups depends on how many possible banking mistakes you want to deal with in the early days of your business.

Yes, Chase offers many different business checking and savings accounts but Chase also has a tough record in working with minority communities, overall bad behavior and a lot of negative customer reviews.

There are a lot of other banks that offer competitive services without the complicated history that might save you a lot of grief while working on all the other frustrating bits in starting a company.

Yes, Chase does have a monthly fee with amounts determined by which kind of account you are using. For business accounts, the monthly fee starts at $15/month.

In order to be approved for a business account, you must have a legitimate business. Don't worry, the standards are loose. It can be include hobbies or side gigs that add to your gross income and will be reported as such in your taxes.

Related reading

Methodology

To score and review Chase, we evaluated factors like its business bank account options, fees on those accounts, other products and services, and customer reviews. We also took into account Chase’s history of government action and imposed a penalty on its final score.

Disclaimer

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

Sources

1. Federal Reserve, “Large Commercial Banks.” Accessed July 27, 2022.

2. USA Today, “JPMorgan Pays $55M to Settle Mortgage Discrimination Lawsuit.” Accessed July 27, 2022.

3. Consumer Financial Protection Bureau, “CFPB Orders Chase and JPMorgan Chase to Pay $309 Million Refund for Illegal Credit Card Practices.” Accessed July 27, 2022.

4. Reuters, “JPMorgan Settles Overdraft Fee Case for $110 Million.” Accessed July 27, 2022.

5. Bloomberg, “JPMorgan Settles Military Mortgage Suits for $56 Million.” Accessed July 27, 2022.

6. U.S. Department of the Treasury, “Release of Civil Penalties Information - JPMorgan Chase Bank, N.A. Settlement.” Accessed July 27, 2022.

7. Trustpilot, “Chase.” Accessed July 27, 2022.

8. Bank Branch Locator, “Chase Bank.” Accessed July 27, 2022.

9. Better Business Bureau, “JPMorgan Chase & Co..” Accessed July 27, 2022.