We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

FirstBank Colorado Business Banking Review 2023

Data as of 12/16/22. Offers and availability may vary by location and are subject to change.

FirstBank, sometimes called 1stBank or FirstBank Colorado, offers business and personal banking to people in Colorado, California, and Arizona. But can this small, regional bank outdo big banks and online alternatives―especially when it comes to business banking?

Well, that depends on what you want from your business bank. FirstBank has a solid variety of business accounts and services (including competitive interest rates on some savings options). Plus, it has 24/7 customer service―a big perk. But with branches in just three states, few customer reviews, and some uncommon online banking fees, FirstBank may not be exactly what you want.

Ready to find out more about FirstBank?

FirstBank account options and pricing

FirstBank offers many types of business deposit accounts, including both checking and savings accounts.

We’ll walk you through them―but remember, you’ll have to visit your local FirstBank branch to actually open a new deposit account. It doesn’t accept online applications.

Checking accounts

First off, let’s talk about your FirstBank business checking account choices.

FirstBank offers five different types of small business checking accounts: three that can work for all kinds of businesses, and two specialized accounts.

Small Business Bank small-business checking account

Data as of 12/16/22. Offers and availability may vary by location and are subject to change.

Business Checking offers a versatile, basic checking account that can work for many small businesses. While it does come with a monthly fee, you waive that fee by keeping just $1,000 in your account (or by keeping $20,000 across your business accounts). This account gives you some free transactions. Even if you do end up paying transaction fees, the fees are pretty competitive.

Then you’ve got the Business Analyzed Checking Account. As the name tells you, this is an analyzed checking account―which means you can’t waive any of the fees, but you can offset them with earnings credits (based on your account balance). These types of accounts work best for businesses with big account balances and lots of transactions.

Or you can choose to earn interest on your balances with the Business Money Market Checking Account. No, the interest rate is nothing to rave about (for comparison, Bluevine business banking gets you a 2% rate on balances up to $250,000). But if you like FirstBank and want to earn a little extra, this account may make sense for you. Keep in mind you can waive the monthly fee on this account with a $5,000 daily account balance.

That covers the accounts that can work for all kinds of businesses. But like we said, FirstBank has some specialized checking options too: There’s Non-Profit Checking (if you have a tax-exempt nonprofit) and Club & Association Checking (if you have an unincorporated club or association). Both accounts have no monthly fee, making them an affordable option―if you meet the criteria.

Regardless of which checking account you choose, FirstBank does have some other business fees you should know.

FirstBank business banking fees

Data as of 12/16/22. Offers and availability may vary by location and are subject to change.

While the NSF/overdraft fee and wire transfer fees look pretty standard, we do want to point out the inactivity fee and debit card fees. Lots of banks don’t charge those. Sure, they’re not big fees (and you can easily avoid the inactivity fee by using your account). But with so many online banks offering fee-free checking, we’re disappointed to see these sorts of add-on fees at FirstBank.

Savings accounts

Now that we’ve covered your checking account options, let’s talk savings.

FirstBank offers several types of business savings accounts, including standard savings accounts, money market savings accounts, and time deposit accounts. The right one for your business, of course, depends on your financial needs.

FirstBank small-business savings accounts

Data as of 12/6/21. Offers and availability may vary by location and are subject to change.

If you just need basic savings, Business Regular Savings will do the trick. It has a low monthly fee, making it good for businesses just starting to save. And you can waive that monthly fee with just a $300 account balance.

The Business Money Market Savings sometimes gives you a better interest rate. When we first reviewed FirstBank, this account had up to triple the interest rate of Regular Savings. But that’s not always the case (like right now). And even when this account has better rates, keep in mind you need a big account balance (around $100,000) to get the maximum rate. Interest rate aside, this money market account has a slightly higher monthly fee than Regular Savings, and you need at least $1,000 to waive it.

And for power savers, there’s Business Liquid Asset Savings. This account lets you write checks (six per cycle), and it historically earns the most interest. (Still, we’ve seen much, much better rates elsewhere―like at Small Business Bank.) You need a $20,000 account balance to waive the monthly fee on this account.

Keep in mind that FirstBank limits you to six transactions per month with any of these savings accounts. For more access, you’ll need a checking account.

But if you don’t need much access to your money, you might be interested in one of FirstBank’s time deposit savings accounts.

FirstBank small-business time deposit accounts

Data as of 12/16/22. Offers and availability may vary by location and are subject to change.

These accounts come with terms. Until your account term is up, you won’t be able to take out your money. The tradeoff? You get higher interest rates than you do with other savings accounts.

If you think you’ll want to add more money during your term, the Business Time Savings Account gives you that option. But this account comes with a variable interest rate, which means your rate could go down (even way down) over the length of your term. (Or, if you’re a glass half full kind of person, it could also go way up.) Also, this account comes with a $5 quarterly service charge if you don’t keep at least $100 in your account.

FirstBank’s Business Time Deposit Account doesn’t let you add funds after your initial deposit. You just put your money in and wait. This account comes with a fixed interest rate, so you’ll know exactly how much money to expect in the end.

The Business Premier Time Deposit Account works pretty much the same way―it just has a higher minimum opening deposit and slightly higher maximum interest rates.

And with that, we’ve covered FirstBank’s bank accounts. So let’s talk a bit about how you can manage your FirstBank account with its online and mobile banking.

By signing up I agree to the Terms of Use.

FirstBank features

You’ve already seen one of FirstBank’s best features: its selection of business bank accounts. With multiple options for checking, savings, and time-deposit accounts, FirstBank doesn’t force you into a one-size-fits-all account.

Another big plus? FirstBank has 24/7 customer service. It’s not the only bank for business to offer that, but 24/7 service isn’t exactly common. So if you think you’ll ever want banking help in the middle of the night or on a weekend, FirstBank may hold a lot of appeal.

But while those are both handy features, are they enough to make FirstBank better than other banks?

FirstBank vs. other banks for business

Let’s compare FirstBank to some other traditional banks and a couple online banks.

FirstBank vs. competitors

Data as of 12/16/22. Offers and availability may vary by location and are subject to change.

The biggest difference between FirstBank and those other banks? Availability. FirstBank has a tiny footprint compared to big traditional banks and to online banks. And sure, that’s probably not a problem for Colorado-based small businesses (more on this in just a minute), but it could be an issue for businesses that want to expand to other states and want banking to match.

Then there’s pricing. FirstBank, like pretty much all traditional banks, costs more than online banks (which tend to charge few, if any, banking fees). When compared to other traditional banks, FirstBank ends up somewhere in the middle, cost-wise. It’s not the cheapest bank out there, but it’s not the most expensive either.

But before you decide whether to go with FirstBank or one of the other banking options out there, let’s talk more about the downsides to FirstBank.

FirstBank drawbacks

FirstBank has three drawbacks we want to tell you about: limited availability, a lack of customer reviews, and some unusual banking fees.

Limited availability

We need to be very clear that FirstBank has very limited availability. Yes, its website is at efirstbank.com, which makes it sound like an online bank―but FirstBank is very much a traditional, brick-and-mortar bank.

It’s a pretty small traditional bank, too, with just over 100 branches and 200 ATMs. (Big banks like Bank of America and Wells Fargo have thousands of branches and even more ATMs.)

And as we already told you, those FirstBank branches exist in just a few states: Colorado, California, and Arizona.

If you’re not in one of those states, you’ll need to go with another bank. (We’ve got recommendations for the best bank for business in your state.)

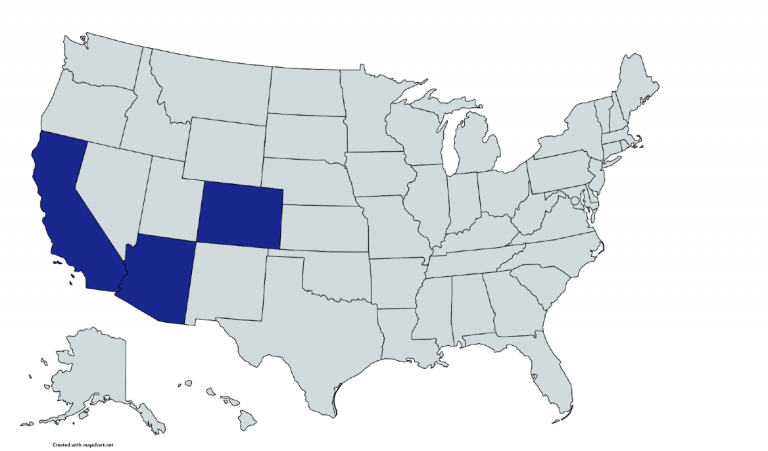

FirstBank availability

Even in those states, though, FirstBank has a fairly limited footprint. FirstBank has just 4 branches in all of California (in Indio and Palm Desert) and just 14 branches in Arizona (in Chandler, Gilbert, Glendale, Goodyear, Mesa, Phoenix, Scottsdale, and Sun City West).

The other 100 or so FirstBank branches are in Colorado (hence it gets called FirstBank Colorado instead of just FirstBank). Mostly you’ll find its branches along the I-25 corridor (from Pueblo up to Fort Collins), though there are some along I-70 and nearby ski towns (from Falcon to Glenwood Springs).

So let’s say your business happens to fall in one of those areas. Great! Does that mean you should open an account at FirstBank?

Well, that depends on what you care about in your business bank. FirstBank does have some advantages, like 24/7 customer service (which even many bigger banks don’t offer) and a nice selection of business accounts. We see the appeal.

Customer reviews

We suspect FirstBank’s limited availability contributes to the lack of customer reviews.

It has no reviews on Trustpilot, for example, which is usually our go-to source for customer opinions.

But we did find some reviews. FirstBank earns a 3.4 out of 5 on Bank Branch Locator, though only a handful of people left actual comments.1 Those comments are pretty divided, with some people praising the excellent service at their local FirstBank branch, while others complain they received terrible service. (This branch-to-branch variation is common among traditional banks.)

FirstBank also has 1 out 5 stars on its Better Business Bureau profile.2 (That score looks low, but frankly, it’s comparable to the scores other traditional banks get.) The small number of reviews there are all complaints, mostly about customer service.

All in all, FirstBank’s small number of reviews look a lot like the reviews other traditional banks get. There’s nothing particularly damning―or enticing.

Unusual fees

The final downside? Some of the weird fees FirstBank charges.

For example, you may have noticed earlier that FirstBank charges debit card fees and inactivity fees. Sure, it’s not the only bank out there to have those kinds of fees―but when so many banks don’t charge them, we’re annoyed when we do see those fees.

Just as annoying are FirstBank’s online banking fees.

As we’ve pointed out, FirstBank is a brick-and-mortar bank that requires you to take care of some banking―like applying for a new account―in person. But like most traditional banks, it does offer online banking and mobile banking to current customers.

With its online banking, you can check on your accounts, view transactions and statements, transfer money between accounts, set up notifications, pay bills, and more. You just have to sign up on FirstBank’s website (again, after you’re already a customer).

Like we said, though, FirstBank online banking comes with fees. Basic account management costs $10 per month, unless you sign up for eStatements (then it’s free). And bill payment costs another $5 per month, with no option to waive that fee.

Again, we don’t like seeing these fees given that so many other banks let you do all that (and more) for free. Still, at least FirstBank lets you waive some of the online banking fees with paperless billing―so make sure you enroll in that.

Browse hundreds of loan options, custom-tailored to your business and budget needs, from a single, simple platform.

Other small-business products and services from FirstBank

Deposit accounts aside, FirstBank offers a few more banking services we want to tell you about.

Small-business financing

First up, financing. FirstBank has a number of loan and line of credit options to let your business get the money it needs to grow.

Compare FirstBank’s small-business lending

Data as of 12/16/22. Offers and availability may vary by location and are subject to change.

Just term loans, which can be used for working capital, debt refinancing, and commercial real estate.

Again, that’s a pretty limited offering when compared to the bigger banks. But with low rates, long terms, and a wide range of loan amounts, Small Business Bank seems like a great option if you operate in Kansas or Missouri.

Small-business credit cards

For day-to-day expenses, FirstBank also has a small-business credit card.

The FirstBank Business Visa Credit Card gets you cashback rewards―between 1% and 1.75% (depending on how much you spend). There’s no annual fee (yay!), and you can get a 0.00% introductory APR for your first six months (with an ongoing APR between 15.15% and 18.15%).

As an added bonus, FirstBank lets you create and control employee credit cards. You can set account permissions and spending limits on these, so you never have to worry about an employee throwing off your budget.

(And as with all things FirstBank, you need to apply for these credit cards in person at a branch location.)

Miscellaneous

And finally, FirstBank has a handful of other banking services that may interest your business:

- Merchant services (credit card processing)

- Treasury management

- Cash concentration service (like sweep accounts)

The takeaway

FirstBank isn’t one of the bigger traditional banks out there, but it has all typical business banking services you’d find at one―as long as your business is in Colorado, California, or Arizona.

With many choices of business bank accounts and other business services, plus nice bonuses like 24/7 customer service, FirstBank can offer a good business banking experience. But it has many of the drawbacks of other traditional banks (like requiring in-person applications), plus some less-common downsides (like extra fees and very few customer reviews).

So while FirstBank may be a fine option for your business, you could probably do well with other banks as well. The choice is yours.

Want a business bank with fewer fees than FirstBank? Check out our rankings of the best free business checking accounts.

Related content

Methodology

To review FirstBank, we looked into things like its business account options, banking fees, customer reviews, and more. We used this information to score FirstBank in more than a dozen categories, and then calculated an overall score. For additional context, we compared FirstBank and its scores to dozens of other banks for business.

FirstBank FAQ

FirstBank has branch and ATM locations in three states: Colorado, California, and Arizona. (Most of the locations are in Colorado.)

The routing number for FirstBank is 107005047.

Does FirstBank have a mobile app?

Yes, FirstBank has a mobile app. You can download the FirstBank mobile app on both the Google Play store and the Apple app store.

Disclaimer

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

Sources

- Bank Branch Locator, “FirstBank.” Accessed December 16, 2022.

- Better Business Bureau, “FirstBank of Colorado.” Accessed December 16, 2022.