We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

PNC Bank Business Account Review 2023

Data as of 9/22/22. Offers and availability may vary by location and are subject to change.

The bottom line: PNC has lots of bank account options, some nice signup bonuses for new customers, and quite a few other banking services for your business. Unfortunately, PNC also has fairly high minimum deposits, doesn’t offer banking nationwide, and doesn’t publish important information like interest rates.

By the time we’re done, you’ll know all that and more about PNC—and hopefully you’ll know if it’s right for you.

PNC Bank business bank account options and pricing

Most of PNC’s business bank accounts are checking accounts—including some niche, specialized accounts. It also has a couple of options for business savings, though.

PNC has some unique bank accounts, but it also has higher costs and fees than many other banks we’ve reviewed. These costs aren’t high enough to break the bank, but if you want a cheaper alternative, you can look at our list of the best free business checking accounts.

Checking accounts

Let’s start by taking a look at PNC’s basic checking accounts. These generic accounts are versatile enough to meet the needs of most businesses. You’ll just have to decide which tier you want.

Now, PNC isn’t the only bank to throw a little something extra at new customers from time to time. But PNC pretty much always has some kind of offer (unlike other banks that have blink-and-you’ll-miss-it deals), and those offers are pretty good to boot.

So if you want to get rewarded for opening a new bank account, then go ahead and apply for one with PNC.

Just note that, because it’s a traditional bank, PNC may not be available in your state. Right now, it has branches in just 21 states, plus the District of Columbia.

Still interested? Then let’s dive into PNC’s bank accounts.

PNC Bank business account options

Most of PNC’s business bank accounts are checking accounts—including some niche, specialized accounts. It also has a couple of options for business savings, though.

Checking accounts

Let’s start by taking a look at PNC’s basic checking accounts. These generic accounts are versatile enough to meet the needs of most businesses. You’ll just have to decide which tier you want.

PNC Bank small-business checking accounts

Data as of 12/15/22. Offers and availability may vary by location and are subject to change.

If you don’t use your account much, you might want the basic Business Checking account. It doesn’t give you many free transactions or deposits, but it does have the cheapest monthly fee—which you can waive by keeping a $500 minimum balance in your account, spending $500 on your PNC business credit card, or making $500 of merchant services deposits through PNC.

Business Checking Plus more than triples your number of free transactions and doubles the amount of cash you can deposit for free. But it has a higher monthly service fee, and it’s harder to waive. You can keep a $5,000 minimum account balance, spend at least $5,000 on your business credit card, have $5,000 worth of merchant services deposits, or have a $20,000 balance across your checking and money market accounts.

If you prefer to pay for what you use rather than have a number of free transactions, you can get Business Analysis Checking. You’ll pay for each transaction and deposit, but you can get earnings credits based on your average monthly balance. These credits can be applied to both transaction fees as well as the monthly maintenance fee. So if you keep a large balance, this plan could end up being a surprisingly affordable option.

The Treasury Enterprise Plan gives you the most free transactions and cash deposits—five times as many as other plans. You can waive the service fee with a $30,000 balance across your accounts. Note that this is technically a plan and not an account; it gives you Analysis Business Checking plus a Money Market or Business Sweep account. You can also get four other checking accounts and link them.

But what about those specialized checking accounts we were talking about?

PNC Bank specialized business checking accounts

Data as of 12/15/22. Offers and availability may vary by location and are subject to change.

MMDA Sweep makes it easy to earn more from your money. You’ll choose both a minimum and maximum target balance for your checking account. Funds over the max balance will get “swept” into a linked Money Market account (see below). But if your balance ever drops below your minimum, funds will automatically get transferred from the money market account to your checking account. Easy, right

Your Sweep account has to link either an Analysis Business Checking account (in which case your Sweep account costs $30 per month) or a Treasury Enterprise plan (which gives you a free Sweep account.)

If you’d rather just earn interest in your checking account, you can go for Business Interest Checking instead. This interest-bearing checking account has a variable rate (so your interest rate can change at any time). You can waive your monthly fee by keeping a $5,000 account balance. And remember, the higher your balance, the more you earn, so this account will work best if you keep a healthy checking balance.

Then there’s Nonprofit Checking. You’ll have to have a qualified nonprofit or not-for-profit organization to open one of these. It looks pretty much like PNC’s Business Checking account, but with a lower monthly maintenance fee. You can waive the fee with a $500 average monthly balance in your account.

Finally, PNC has special trust checking accounts for attorneys. While it groups these under Interest On Lawyers Trust Accounts (IOLTAs), these include IOTAs, IOLAs, MJ IOTAs, IBRETAs, and MAHTs (we assume that if you’re the kind of business that needs these accounts, you already know what all that means). These accounts are subject to your state’s IOLTA regulations, so make sure you use them properly. We don’t want you getting disbarred, after all, and we can’t imagine PNC does either.

Savings accounts

Compared to its checking accounts, PNC’s business savings account options seem pretty limited. Really, you’ve got only two choices.

PNC Bank small-business savings accounts

Data as of 12/15/22. Offers and availability may vary by location and are subject to change.

If you want access to your savings, then check out PNC’s Premium Business Money Market Account. This account has a variable interest rate, so you’ll need to talk with your local branch to find out current rates.

You can make up to six transactions (including withdrawals) per cycle with PNC’s money market account. (Note that those limited transactions from savings accounts are a PNC policy―it’s no longer a government-mandated rule.) And if you want to waive the monthly fee, you just need an average balance of $2,500 in your account.

If access isn’t an issue, then certificates of deposit (CDs) often offer the best APY for savings. You can’t deposit or withdraw money from your CD during the term, so make sure you’re really ready to commit to saving before you open one. Plus it requires a high opening balance of $1,000. But with no maintenance fee or other fees to speak of, CDs can be a good way to build your business savings.

By signing up I agree to the Terms of Use and Privacy Policy.

Features

Aside from the good variety of accounts we’ve already shown you, PNC has more good features you should know about―like those signup perks we mentioned.

PNC regularly offers incentives to new small-business customers, like $200 for opening a PNC checking account, waived bank account fees for your first few months, and bonus earnings on your PNC business credit card.

Now, PNC isn’t the only bank to throw a little something extra at new customers from time to time. But PNC pretty much always has some kind of offer (unlike other banks that have blink-and-you’ll-miss-it deals), and those offers are pretty good to boot.

We’ll tell you more about the specific perks PNC offers, but first we do want to note that PNC’s offers do expire. So the specific offers we discuss here may not exist in a few months. As far as we can tell, though, PNC consistently replaces expired offers with new ones. So you should, with any luck, always qualify for at least some kind of neat perk.

Checking accounts

You can get a couple different incentives when you open a PNC business checking account.

Many of its business checking accounts waive the monthly account maintenance fee for your first three months. That means you can get a free trial of sorts (you’ll still have to pay other fees) to see if you like your new account.

This offer applies to the following accounts:

- Business Checking

- Business Checking Plus

- Business Interest Checking

- Nonprofit Checking

- Treasury Enterprise Plan

Plus, PNC usually has a deal that gets you free money for opening a business checking account. For example, you can get $200 for opening a Business Checking or Business Checking Plus Account. And you can get $500 for opening an Analysis Business Checking or Treasury Enterprise Plan.

You will have to meet some conditions, like keeping a certain account balance and making debit card purchases―pretty routine stuff. But in return, you’ll get free money in your PNC bank account. Neat, huh?

PNC stands for Pittsburgh National Corporation and Provident National Corporation—the two banks that merged to create the PNC we know today.

Credit cards

You can also get signup bonuses on certain PNC credit cards.

Take the PNC Cash Rewards® Visa Signature® Business Credit Card. It lets you get a $200 bonus when you spend $3,000 in your first three months. Or if you’re a big spender, there’s the PNC BusinessOptions® Visa Signature® Credit Card. It can get you a $750 credit when you spend $25,000.

Some credit cards also come with a promotional (low or no) APR for your first year, so you can save that way.

Put simply, PNC’s offers can sweeten your signup quite a bit. So when you apply for a bank account or a credit card, make sure you ask about any current deals for new customers.

PNC Bank vs. competitors

Data as of 12/15/22. Offers and availability may vary by location and are subject to change.

For the most part, yeah. PNC may not be the cheapest bank out there, but it’s pretty similar to many other traditional banks and cheaper than some. Yes, online banks like Bluevine absolutely cost less than PNC Bank―or any traditional bank―but you could do worse, cost-wise, than PNC.

PNC’s also pretty middle-of-the-pack in terms of availability. While it’s not in as many states as the biggest banks (like Bank of America, Chase, and Wells Fargo), it’s got more coverage than plenty of regional banks. Again, though, online banks beat out PNC and other traditional banks by offering service in all 50 states.

One other thing PNC has going for it? As we showed you, it has lots of different accounts. Since more and more banks seem to be simplifying their account options, it’s nice that PNC still gives you a good variety to choose from.

Drawbacks

That said, PNC definitely isn’t flawless. It’s got some drawbacks you should know about.

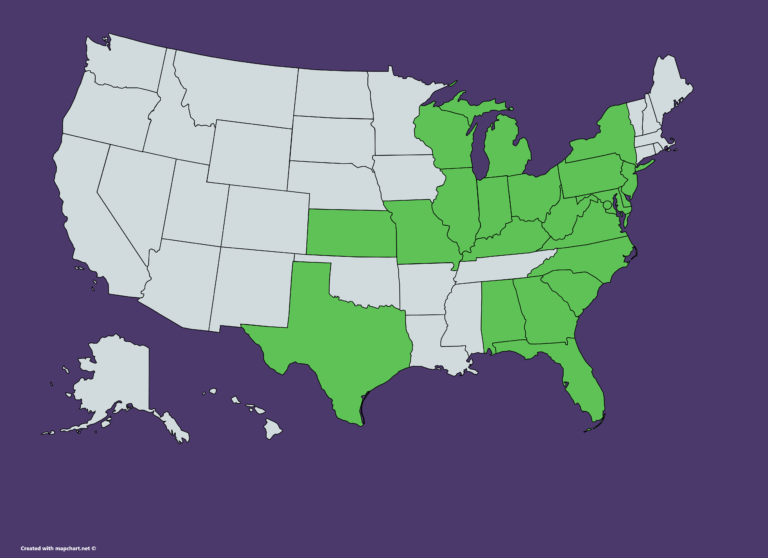

For starters, because it’s a traditional bank, PNC may not be available in your state. Right now, it has branches in just 21 states, plus the District of Columbia.

PNC Bank availability

So you’ll definitely want to make sure that PNC operates where you do. (If it doesn’t, we’ve got a guide to the best bank for business in your state.)

Another downside? The minimum opening deposits on PNC bank accounts are higher than you’d see at many other banks. They’re not outrageous, by any means, but plenty of banks let you fund a new account with anywhere from $0 to $50. PNC, with its $100 minimums, falls on the high end of that spectrum. For brand-new businesses and freelancers, that can make opening a new PNC account more costly than you’d like.

And one more thing: PNC doesn’t publicize its interest rates at all, for either the rates its business savings (money market and CDs) earn or for the rate you’ll pay on its business financing. That’s super annoying, especially as PNC (like many banks) has been harder to get a hold of lately. It’s not like you can just call PNC up and get told its rates in 30 seconds, these days.

Want affordable banking with great perks? With Bluevine, you can get a fee-free business checking account―and you can even earn up to $5,000 in interest.

Other small-business offerings from PNC Bank

Don’t consider those drawbacks to be dealbreakers? Great. Then let’s take a look at all the other banking products PNC has for small-business owners.

Small-business financing

PNC has a number of business financing options, from small lines of credit to large commercial real estate loans.

Compare PNC Bank’s small-business lending

Data as of 12/15/22. Offers and availability may vary by location and are subject to change.

To qualify for a PNC loan, you’ll usually need to have been in business for at least three years. PNC will also look for a solid credit report and a history of profitability―among other things.

PNC doesn’t list interest rates or APR on its business loans (you’ll have to talk with your branch to get details) so we can’t tell you exactly how those compare to other lenders.

But PNC’s variety of loan options, flexible loan amounts, and lengthy repayment terms make it a good bet for businesses that can qualify for traditional financing—especially if you’re already using PNC for other business financial needs.

Small-business credit cards

PNC has five different Visa credit card options for businesses. Four of these have no annual fee (nice!), and the fifth has options for waiving the fee (assuming you’re a big spender, of course).

You can choose between several types of rewards, including cash back, travel, and points—whatever makes the most sense for your business. Plus, several of the cards have special offers when you spend a certain amount after opening an account.

PNC even has options for employee credit cards, so you don’t always have to let your staff borrow your card to go buy more reams of paper.

Cash Flow Insight

Cash Flow Insight is basically PNC’s advanced online banking software suite. It lets you do all the basics of online banking, like viewing your account balances, paying bills, and scheduling account transfers (all of which you can do with PNC’s normal online banking)—but it goes beyond that.

Compare PNC's online banking

Data as of 12/15/22. Offers and availability may vary by location and are subject to change.

Cash Flow Insight lets you do a deep dive into your spending by organizing your credit card spending into different categories. It also lets you plan for the future by forecasting account balances and payments. Likewise, it helps you plan future transactions and see how they’ll affect your accounts.

If you use invoices as part of your business, you can even get Cash Flow Insight with Payables/Receivables. As you probably already guessed, it lets you make and send invoices. It also makes it easy to accept payments for those invoices. Plus, it lets you sync Cash Flow Insight with your accounting software.

Miscellaneous

PNC also offers some other services that might interest you, such as these:

- Merchant services

- Treasury management

- Payroll processing

- Bank-at-work program

- IRA retirement plans

- Tax-advantaged accounts (HSAs, HRAs, FSAs, QTAs)

What customers say about PNC Bank

Overall, PNC has a fairly average reputation with customers, though its ratings have declined some over recent months. It earned a 1.3 out of 5 on Trustpilot and 3.1 out of 5 on Bank Branch Locator.1,2 (Those scores may not look all that positive, but they’re actually a little higher than most banks earn.)

Most of the reviews we saw were pretty specific to local branches. Positive reviews praised the customer service at their local branches, often thanking PNC employees for their specific, actionable advice. On the other hand, negative reviews complained about poor customer service and grumpy branch employees. Oh, and broken ATMs. Lots of broken ATMs.

That means your PNC experience will depend a lot on the staff at your local branch and who’s working when you show up. So hopefully your local branch is one of the good ones.

We have seen some recent complaints that PNC doesn’t deal with fraud well. Customers complain that PNC didn’t alert them to suspicious transactions and that PNC made it difficult to dispute fraudulent transactions.

Oh, and a lot of the recent negative reviews come from BBVA customers annoyed about the transition to PNC Bank. (PNC acquired BBVA in 2021.) We’re not saying their complaints are illegitimate, but lots of them won’t apply to you as a new customer.

So keep an eye on your PNC bank accounts. But rest easy knowing that PNC doesn’t have the kind of company-wide scandals that many other big banks have.

The takeaway

So should you get a business account from PNC? We still don’t have the answer, but hopefully you do.

PNC offers some nice bonuses when you get a new bank account or credit card, which can help you feel better about signing up. And even if you don’t care so much about those offers, PNC has versatile accounts and financial services that can work for many businesses—even if those cost a little more than other banks do.

Still, PNC’s limited availability and high minimum opening deposits keep it from being a great fit for all business owners. Likewise, the lack of published information about interest rates may lead you to choose a different bank instead.

Not sure PNC has the right bank account for you? No problem. Check out our ranking of the best banks for small business to find a better fit.

Related reading

Methodology

We scored PNC Bank on more than one dozen factors, from bank account fees to customer service options to branches and availability. These scored factors gave us our overall score for PNC, which we used to inform this review and to compare PNC Bank to other banks for business.

Disclaimer

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.