We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

The 5 Best Mobile Credit Card Readers for Your Small Business in 2025

Data as of post date. Offers and availability may vary by location and are subject to change.

*Promotional price for first reader

Mobile card readers are great for taking sales on the go, on the sales floor, and anywhere else you want to do business.

That said, not all mobile readers are created equally. Some simply process credit cards while others are connected to sophisticated POS software.

So which product and service is right for your business? We put Square on the top of our list because it’s not only a great point of entry, but it also comes packed with POS extras. But we also chose some other great readers that are worth your consideration.

- : Best overall mobile credit card reader

- : Cheapest transaction fee

- : Best for pop-up shops

- : Best for QuickBooks users

- : Best for high transaction volume

With only 10% of your customers always using cash, having a mobile card reader is a must.

Compare the best mobile credit card readers of 2023

Data as of post date. Offers and availability may vary by location and are subject to change.

*Promotional price for first reader

Square: Best overall

Data as of post date. Offers and availability may vary by location and are subject to change.

For low and simple fees, a free and easy-to-set-up reader, and funding as fast as one day, Square is the best overall choice for small businesses that need a quick, affordable, and user-friendly way to accept credit card payments on the go.

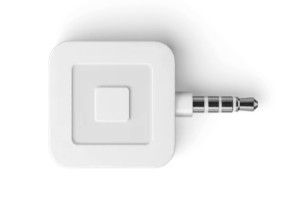

The Square reader and the Square mobile app for iOS and Android make up one of the most recognizable and popular mobile credit card processors available—and for good reason.

With Square, you get a free card swipe reader and access to the free Square mobile point-of-sale (mPOS) app. Square’s fees aren’t the cheapest—but they are the simplest. You pay a flat 2.75% for all swiped credit card transactions with no extra per-transaction or monthly subscription fees.

Square accepts all major credit cards, including American Express, and iy works on all iOS and Android mobile devices. And while Square's fees aren't the cheapest, they are the simplest. You pay 2.6% + $0.10 for all swiped credit card transactions with no extra monthly subscription fees.

Manually entered transactions will cost a bit more per entry at 3.5% + $0.15. But if your service goes offline, you can take advantage of Square's offline mode and pay the same flat processing fees for swipers.

If you want to accept regular magstripe payments, you’ll need to buy a Square Reader for magstripe that fits either your headphone jack or your iOS lightning connector—both of which cost just $10. For chip cards and “contactless” payments like Apple Pay or Google Pay, you can purchase the $49 NFC reader or shell out $299 for Square’s three-in-one, battery-powered reader to take all types of credit card payments.

Square promises to deposit your money within one to two business days. This is about average, but it lacks the guaranteed next-day funding option offered by other products. It also touts a suite of high-end security and encryption protection, so you can trust in the safety of your and your customers’ money and information.

Clover Go with National Processing: Cheapest transaction fees

Data as of post date. Offers and availability may vary by location and are subject to change.

What happens when you combine the power of two great brands? You get the ultimate mobile processing synergy. That’s what buying a Clover Go reader through National Processing is all about. You get both a top-tier reader and some of the lowest processing rates in the world. That’s a deal that’s hard to beat.

So how do you bundle Clover Go and National Processing? You have to start with National Processing. You can sign up for their processing services for an extremely low monthly fee of $9.95 per month. Once you’ve signed up, you’ll be able to purchase a mobile reader.

National Processing actually sells many different mobile processors. They’ll even give you one for free if you sign up for a new account and have a processing volume of $10,000 per month. Their free mobile reader is good, but we recommend buying yourself the Clover Go mobile reader. The Clover Goreader integrates with Clover’s great mobile POS software.

Additionally, if you ever want to expand beyond mobile processing, Clover has an amazing line of powerful POS devices including their Flex machine. The Clover Flex can be purchased through National Processing and is a full fledged POS system that also has mobile capabilities. It’s a solid upgrade that lets you combine the flexibility of a mobile device with the power of a POS system.

Of course, we can’t forget to mention National Processing’s side of this bargain: the incredibly low processing rate. National Processing has rates as low and even lower than 0.18% + $0.10. You can get lower rates if you have high processing volume. That means you pay less as your business succeeds more. Not a bad deal if you ask us.

When you combine the forces of National Processing and Clover, you get the ultimate two-headed processing dragon. It’s yin and yang, ice and fire, and one of our top recommendations.

Shopify Tap & Chip Card Reader: Best for pop-up shops

Data as of post date. Offers and availability may vary by location and are subject to change.

Pop-up shops are a trendy way to run a business. They allow online small-business owners to try out a new revenue stream: in-person sales. If you’re one of the tens of thousands of online retailers selling art, clothes, or jewelry—for example—setting up a booth or kiosk could boost your brand and your profits.

Shopify’s platform has long provided retailers a place to sell their wares online, but did you know it also offers an in-person sales solution?

With Shopify’s robust mobile app, online store, and mobile card readers, you can start selling products and processing payments wherever your customers are.

The Shopify POS service starts at $29 per month for the Basic plan, which provides shipping label support, retail reports, and a free swipe card reader for up to two users. In-person transactions on the Basic plan cost you 2.7%, while online rates start at 2.9% + $0.30 per transaction.

These costs put Shopify in the more expensive column compared to some of the other brands we reviewed. But for occasional in-person sales, it’s a good investment.

Plus, Shopify offers lower fees when you upgrade your plans. For example, the $79 per month plan has in-person fees of just 2.5%. If you plan to expand your physical retail presence and set up a more permanent store, this plan is super affordable.

Shopify’s app and readers work with iOS and Android mobile devices and accept all major credit cards. Online reviews of the apps are just so-so, but you can access Shopify customer support 24/7.

The bottom line is if you’re thinking of testing out a physical presence for your burgeoning online store, Shopify is an excellent choice.

By signing up I agree to the Terms of Use and Privacy Policy.

QuickBooks Chip and Magstripe Card Reader: Best for QuickBooks users

Data as of post date. Offers and availability may vary by location and are subject to change.

QuickBooks Chip and Magstripe Card Reader service allows you to accept and track any payment type—including PayPal, cash, and checks—through the mobile app. And it syncs up with your QuickBooks account to deliver robust solutions for both mobile and desktop users who want to accept in-person payments and online payments through their website.

From the familiar financial software company Intuit, GoPayment is the best mobile card reader for businesses already using QuickBooks accounting and sales software.

To use GoPayment, you’ll need a QuickBooks account. It costs $30 (or $15 when it's on sale) per month and allows you to enjoy transaction fees as low as 2.4% + $0.25, which is a totally decent price.

Of course, the greatest advantage to the GoPayment reader and app is its integration with Intuit’s QuickBooks software. Many businesses use QuickBooks to manage payroll, inventory, sales, and other functions, so integrating your mPOS system with the accounting software is a major upside.

The downsides? GoPayment includes higher monthly costs, and the service doesn’t offer a contactless payment reader. That means you won’t be able to process Apple Pay, Android Pay, or other “contactless” forms of payment.

That being said, GoPayment’s QuickBooks integration may compensate for the service’s higher monthly fees because your transactions are automatically recorded and synced with your bookkeeping software.

Stax Mobile Reader: Best for high transaction volume

Data as of post date. Offers and availability may vary by location and are subject to change.

If your business does a large number of transactions—about 1,000 or more per month—Stax offers an enticing monthly subscription service with exceptionally low processing fees.

Stax eschews the traditional per-transaction rate of its competitors and charges just a monthly subscription cost plus a low per-transaction fee. Other mPOS solutions bake the interchange fees into their transaction rates, but Stax charges you the interchange rate only and doesn’t take a cut above that number.

The standard $99 subscription gets you an EMV-ready mobile card reader, access to its virtual mPOS software, and integration with major POS merchant terminals. Each transaction costs you only what cardholders’ banks charge for interchange fees.

Stax provides free 24/7 technical support, analytics, and tools. Long-term customers are eligible for next-day bank account funding. But it’s probably not a great option for smaller businesses with fewer transactions. In addition, the mobile card reader currently works with only iOS mobile devices, and Stax doesn’t currently offer a solution for contactless payments.

Payanywhere: Cheap mobile alternative

Data as of post date. Offers and availability may vary by location and are subject to change.

For a competitively priced option, consider Payanywhere’s low transaction fees, free reader, and lack of monthly fees.

With Payanywhere, you get a free credit card reader, and you pay no monthly subscription fees—just 2.69% per transaction with the Pay As You Go package.

Yes, that’s a bit higher than QuickBooks Chip and Magstripe Card Reader’s 2.4% transaction fee, but GoPayment also charges an additional $0.25 per transaction. If your business will be taking a large volume of small mobile payments, those per-transaction fees could add up.

For example, if you did a thousand $5.00 transactions in one month, you’d pay $134.50 in Payanywhere transaction fees. GoPayment would leave you with $420.00 in fees. That’s quite the difference!

The Payanywhere app’s mPOS services also include personalized receipts, inventory management, customer purchase reporting, online resources, and multilingual customer support—all at no extra cost.

The takeaway

Overall, the popular, affordable, and secure Square mobile card reader is the best choice for most small businesses. But depending on your business’s needs, one of our other favorite mobile card readers may be the right one for you.

- The Shopify reader is great for your mobile shop

- The Clover Go reader in combo with National Processing saves you money on processing fees

- Quickbooks mobile reader is a turn-key solution for current Quickbooks users

- Paypal Zettle gives you the most payment options

Want a mobile card reader that integrates perfectly with your point-of-sale system? Check out the hardware costs for our favorite POS systems.

Mobile credit card reader FAQ

Have you recently decided you need to start accepting mobile payments but aren’t sure about some of the details? Start here to learn the basics.

A mobile point-of-sale system, or mPOS system, is a program that runs on a smartphone or tablet and uses software to process business transactions like a traditional POS terminal. The advantage of an mPOS system is that it can function without the need for expensive electronic cash registers or merchant services—and it can be used just about anywhere.

A mobile card reader is an electronic device that connects to an mPOS system to accept credit and debit cards. Basic readers let you swipe cards to take payments. Higher-functioning devices can accept EMV (chip card) and NFC (contactless) payments too.

Magstripe is short for magnetic stripe, referring to credit cards that store information in a band of magnetic material. All mobile card readers can accept magstripe cards.

EMV stands for Europay, MasterCard, and Visa, and the term is used for a rapidly developing worldwide standard for credit card payments. EMV-enabled readers can accept microchip cards that allow for more secure authentication of card transactions.

Near-field communication (NFC) readers accept “contactless” card payments like Apple Pay and Google Pay. These readers are called contactless because the card information is stored on a separate device — such as a smartphone — which needs only to be placed near the reader to initiate a transaction.

To protect your business and customers, you should adopt EMV-enabled readers as soon as possible. Although not all issued cards are 100% chip ready, their use is growing.

Chip cards are harder to counterfeit, which means customers are at a lower risk of fraud. In 2015, the rules governing who is liable in cases of in-store credit card fraud shifted from the credit card companies to businesses that don’t adopt the EMV-reading standard. So you’ll be liable for a counterfeit purchase if it’s made using a chip card, but if your business uses EMV readers, your risk in counterfeit cases is reduced. It’s a win-win!

Methodology

The top twenty mobile readers on the market were considered. Those readers were narrowed down into five top picks and two honorable mentions based on a multitude of factors including: hardware reliability, POS features, reader cost, processing fees, monthly fees, and business use case factors.

Disclaimer

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.